ETF liquidity and why it matters

How easy is it to buy and sell ETFs?

One of the key advantages of ETFs is that they can be traded throughout the day on a stock exchange. This allows for greater flexibility and means that ETFs can be turned to cash quickly, if needed. Let’s look at how ETF liquidity works and explore an example of the liquidity of an ETF that has low assets under management (AUM) as well as low trading volume.

How to determine an ETF’s liquidity

One of the myths about ETFs is that ETF trading volume is equal to the liquidity of the ETF. ETF trading volume is the average number of shares that are traded in the fund over the course of a day.

Why is ETF liquidity important? Lower levels of ETF liquidity can lead to a greater bid-ask spread, which is the difference between the highest price someone is willing to pay for the ETF and the lowest price the owner of the ETF is willing to sell it at. Ultimately this can lead to higher transaction costs for investors when buying or selling an ETF.

However, the average daily ETF trading volume (ADV) makes up only a small portion of an ETF’s overall liquidity.

When it comes to an individual company, it typically has a fixed supply of shares trading on the open market, and the average daily trading volume is a strong indicator of its liquidity. However, while ETFs also trade on an exchange just like stocks, they are open-ended investment vehicles — this means that they can issue an unlimited number of units. ETF liquidity, therefore, is not limited by the number of ETF units that currently exist.

Buying into a low-AUM/low-trading volume ETF

Let’s look at a hypothetical example of a trader looking to invest $50 million into the Mackenzie Global Infrastructure Index ETF (QINF). This ETF has total AUM of around $5.4 million and has an average daily ETF trading volume (ADV) valued at around $56,000.1 Assets under management (AUM) is a measure of the total market value of all the assets held within the ETF, and it typically fluctuates on a daily basis.

Is it possible to buy ETF shares that amount to roughly nine times the ETF’s current AUM? When you delve into the true liquidity of this ETF, the short answer is yes.

ETFs can source the liquidity of their underlying holdings (the shares that make up the ETF) through what is known as the “creation/redemption mechanism”. This mechanism refers to the primary market, where market makers transact directly with the ETF issuer to create or modify ETF shares, to match the ETF’s demand. You can find out more about this in our article, “ETFs 201: The top ETF questions answered”.

The liquidity of an ETF’s holdings

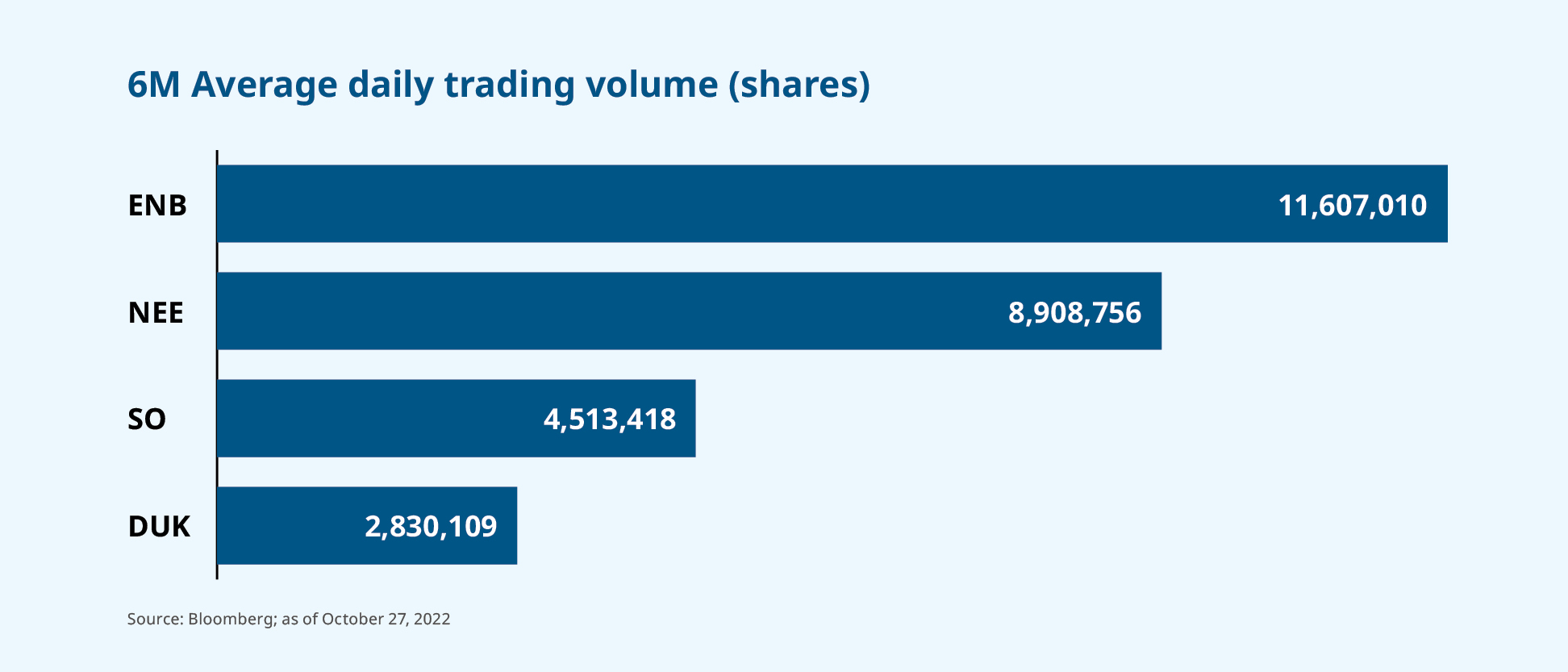

The chart below shows the average daily trading volume of the top four holdings in QINF: Enbridge (ENB), NextEra Energy (NEE), Southern Company (SO) and Duke Energy (DUK). As you can see, all of these holdings are extremely liquid, with millions of shares changing hands every day.

Let’s go back to our hypothetical $50 million investment into QINF. While this trade represents multiples of the ETF’s average daily trading volume, it also represents just a small fraction of the trading of the ETF’s underlying stocks. Because it holds a lot of very liquid assets, the ETF itself is also very liquid.

For example, Enbridge makes up roughly 4.92% of the shares held within QINF: to facilitate a $50 million trade, the market maker would need to buy Enbridge shares valued at 4.92% of $50 million. This is equal to just over 46,000 shares. On average, Enbridge trades 11.6 million shares every day.2 Therefore, the market maker would only need to trade around 0.40% of Enbridge’s average daily trading volume. This process would be repeated for the remaining 99 stocks held in QINF to form the $50 million basket needed for a trade of this size.

In the chart below, we’ve taken the creation basket for QINF and shown how many shares a market maker would need to purchase of each of several of these stocks. In fact, this $50 million trade would at most only constitute 2.39% of the ADV of any of the underlying stocks. Therefore, a market maker could easily source the securities needed to support the creation of new ETF units needed for a $50 million purchase.

This is the basis of the concept of the implied liquidity of an ETF: how easy it is to trade the shares of the holdings held in an ETF.

What about selling ETFs?

A $50 million sale of an ETF would be the reverse of the process above, with a similar lack of liquidity issues:

- A market maker would buy QINF shares from the seller for the fair market price.

- Behind the scenes, the market maker would take steps to return the QINF shares to Mackenzie Investments in return for stocks held in QINF or cash.

You can read more about this topic and other ETF myths in our white paper, Dispel ETF myths with ETF realities. To find out more about the Mackenzie Global Infrastructure Index ETF or ETF liquidity, please talk to your Mackenzie sales team. Investors, please talk to your advisor.

Sources:

1 Bloomberg, as of October 27, 2022; Using the six-month average daily value traded

2 Bloomberg, as of October 27, 2022; Using the six-month average volume

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of October 18, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.