Written by the Mackenzie Fixed Income Team

Key Highlights

- The Bank of Canada may adopt a more aggressive approach to rate cuts if inflation remains below 2%, potentially lowering the policy rate to 2.00% or even below by 2025.

- We expect a 50 basis point decrease in the December BoC meeting and anticipate the Fed to cut rates by 25 basis points each in the next three meetings.

- Due to high volatility and election uncertainty, there is a neutral approach to duration positioning and a focus on lower beta corporate bonds on the front end of the yield curve.

- Donald Trump’s return to the presidency in 2025 has stirred markets with his policies presenting a mixed bag for markets, including potential inflationary pressures from wage increases and tax shifts. We favour our exposure to inflation linked bonds versus nominals in that respect.

- Emerging market risk has been reduced in Brazil and Mexico, with new exposure initiated in Indonesia.

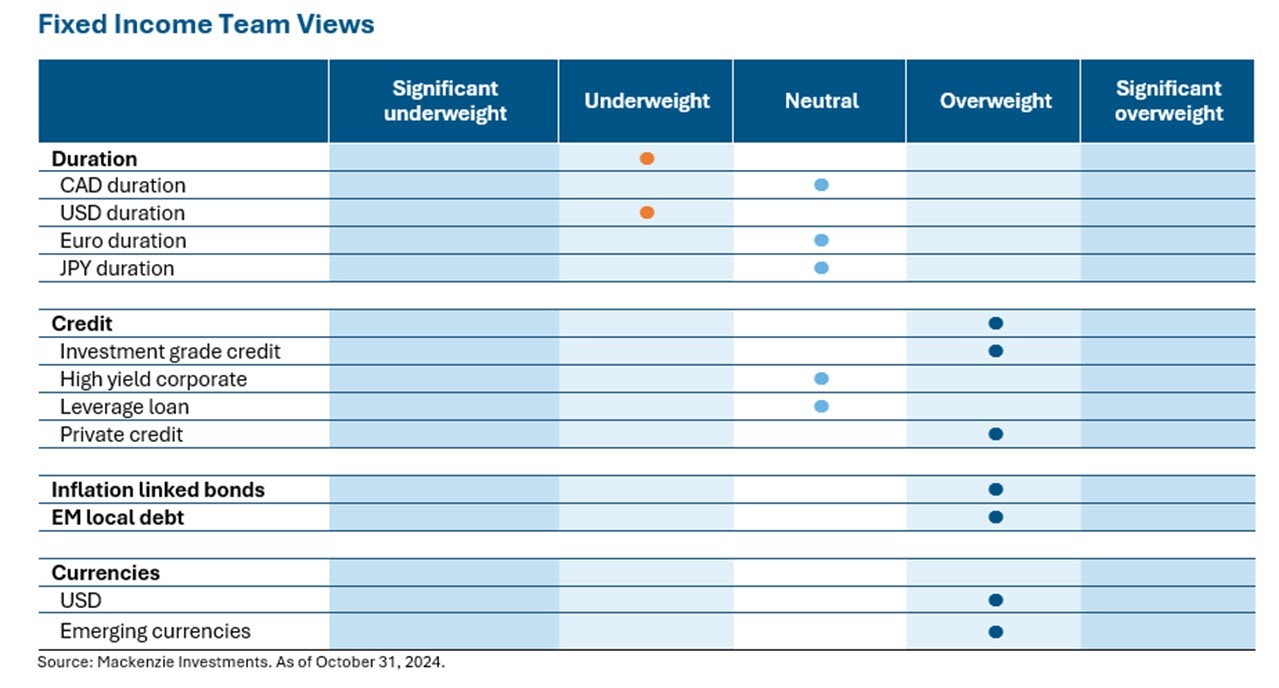

Fixed Income Team Views

Central Bank Watch

US Fed (Fed)

Yields rose during the month amid receding labor market concerns and robust consumer spending. Nonfarm payrolls (measures the number of employees on payrolls) came surprisingly strong and topped the consensus estimate to rise by 254k in September. Headline inflation, while continuing to drift lower with a print of 2.4% for September, suggests that the days of CPI triggering major volatility could be fading. While the receding probability of recession has been supportive for risk assets, stronger U.S. data has caused markets to scale back Fed rate-cut expectations as they increasingly price in a ‘no-landing’ scenario, leading to increased volatility in the treasury market.

Bank of Canada (BoC)

Canadian bond yields rose during the month in line with most of its developed peers. While the unemployment rate continued to remain elevated at 6.5%, the treasuries did celebrate a downside surprise on headline inflation at 1.6% for September. The print was dragged lower on declining costs for gasoline and public transportation. The BoC met the market expectations to deliver with a jumbo 50 bps rate cut justified by inflation within the target range combined with sluggish growth. We believe the BoC has good reasons to cut interest rates all the way to neutral but the rising rate differential versus the US could have a significant impact lower on the loonie.

European Central Bank (ECB)

The ECB, in line with consensus, lowered interest rates by 0.25% to 3.25% comforted by on track disinflationary process. Economists now estimate cuts at every ECB meeting through March before a switch to quarterly moves. Eurozone inflation, released only hours prior to the ECB meet, came in lower than expected and moderated to 1.7% in September. With the Fed comments recalibrating policy rate cut expectations just as the ECB continues to lower rates likely at an accelerated pace, the widening interest rate differential is likely to weigh on the euro.

Bank of Japan (BoJ)

The BoJ left its benchmark rates unchanged at 0.25% as widely expected by market participants, while sticking to its view that it’s on track to achieve its inflation target. The BOJ also cited increasing nominal wages as a sign of greater confidence for a wage-inflation virtuous cycle for sustainable price growth. The yen advanced as much as 1% against the USD post comments from Japan Governor Ueda. The yen still lost nearly 6% against the greenback in October, making it the second worst-performing currency among Group-of-10 peers. We expect the move in domestic currency lower to determine the timing of the BOJ’s next policy move, as a further drop could boost inflationary pressures when households are already struggling with the rising cost of living.

Emerging Markets (EM)

Recent weeks have seen a rise in market volatility and a pick-up in EM financial stress, as the implied probabilities of a Trump presidency increased. Potential trade tariffs from a Trump administration would weigh on EM risky assets. Further accentuated by the recent strengthening of the USD and higher yields. A drought-driven spike in electricity and food prices drove up Brazilian headline inflation in September to 4.42% cementing market expectations of a 0.50% hike in its November meeting. South Africa’s inflation at 3.8% for September, fell below 4% for the 1st time in more than three years contributed by fall in food and fuel prices. Drop in inflation near the lower end of the central bank’s 3%-6% target range will likely persuade the officials for a second consecutive rate cut in November. Indonesia looks interesting as well with inflation print of 1.71%, near the lower end of 1.5%-3.5% target range. We expect gradual reduction of policy rates, however the reaction of the rupiah to the upcoming US election result and the Federal Reserve's policy announcement will serve as a catalyst to the decision. Mexico’s annual inflation slowed more than expected at 4.58% in September, likely helping to keep a third straight interest rate cut in play at the central bank’s next meeting.

Duration and Curve Positioning

We believe the BoC is likely to adopt a more aggressive approach to rate cuts if inflation remains below 2%. The significant undershoot in inflation has highlighted vulnerabilities in the Canadian economy, prompting the BoC to consider faster and more substantial rate reductions to support economic growth. The bank might be underestimating potential economic challenges & may need to implement more drastic measures than currently anticipated, potentially lowering the policy rate to 2.00% or even below by 2025. The return of Donald Trump to the presidency in 2025, has stirred both markets and political discourse. Trump’s sweeping victory, including the presidency, senate, and likely the house, underscores his unorthodox yet effective approach to governance. However, his policies present a mixed bag for markets, with potential inflationary pressures from wage increases and tax shifts countering claims of deficit reduction. We believe the market is underpricing the December BoC meeting and expect a 50 basis point decrease. We anticipate the Fed will cut rates by 25 basis points in the next three meetings. We are cautious with duration positioning due to high volatility and uncertainty surrounding the election. The cautious duration positioning and focus on lower beta corporate bonds contributed positively to performance. We reduced emerging market risk in Brazil and Mexico, and now have negligible exposure. We initiated our exposure to Indonesia, expecting positive impacts from China's economic activity and a favorable inflation outlook. As bond yields rise and market volatility looms, the coming months will be crucial for reassessing economic strategies and navigating the evolving political landscape.

Investment Grade Corporates (IG)

Canadian IG bonds returned -0.41%, significantly outperforming the US IG with a return of -2.25%. The negative returns were primarily duration driven led by recalibration of policy rate expectations. Canadian yields were higher by 0.13% and US yields by 0.40% as the spreads continue to remain rich. We prefer to be invested in high-grade (low beta) corporate bonds at the short end of the curve. We prefer the Canadian curve over the US curve in this sector. Continued rate cuts are the base case for Canada and so there is still further potential for significant price appreciation of these securities.

High Yield Bonds (HY)

The US HY index returned -0.52% in October with CCCs (+0.73%) outperforming Bs (-0.38%) and BBs (-0.93%). In line with the generic theme of a stronger economy leading to calibration of rate cut expectations, duration was the detractor from performance. US HY bond yields rose 33bp and spreads decreased 20bp in October to 7.42% and 325bp, respectively, which are down 39bp and 52bp year-to-date. Notably, this was the first monthly loss for HY bonds in 6 months. Outperforming in October were Telecom (+1.18%) and Transportation (+0.14%) with Healthcare (-1.19%) and Housing (-1.04%) underperforming.

Leveraged Loans (LL)

US LL posted +0.86% in October driven coupon clipping (+0.73%) and small price appreciation. The robust demand from both CLOs and retail investors fueled a rally in secondary prices. By the end of October, the three-month term Sofr declined to roughly 4.6% from just under 5% in the first half of September. Although loan yields have now retreated lower thanks to re-pricings, refinancings and September’s rate cut, they remain very attractive relative to historical norms. We expect loans to continue perform well driver by higher base rates, no direct duration risk, strong technicals and decent issuer fundamentals.

Bond Stories

Investment Grade – Short Long-End Duration Theme

Our call to be short long-end duration was a product of both our view of the evolving economic landscape, coupled with our view on expectations for the upcoming US election. After weak prints for the August non-farm payrolls report in early September and other soft data, the market had moved to what we believed was bordering an extreme position for future easing from the Federal Reserve, culminating by mid-September of more than 250bp in cuts by the end of 2025. We believed that while the US labour market was slowing, and the inflation picture becoming increasingly more constructive, there was enough momentum in the underlying US economy that 250bp in easing over the coming 15 months was extreme and would need to reprice.

Additionally, we believed Harris’ post-debate momentum was fading and so-called “Trump trades” were likely to come back into vogue on market speculation he could win the election; this was not an election call per se, only that the market has moved too far in Harris’ direction and required recalibration over the coming two-to-four weeks. Of all the Trump trades, the most liquid and consensus directionally for a Trump win – and possibly a “Red Sweep” – was that the US fiscal picture would deteriorate, resulting in the US Treasury eventually issuing additional bonds, and resulting in higher long-end yields on more supply and less demand. Our preferred vehicle to message the trade was short WN futures, adding positions around yield equivalents first approximately at 4.06% and then 4.15%, before staring to take profits approximately around 4.32% and then 4.38%.

High Yield Bond – New Fortress Energy

New Fortress Energy is a midstream business that owns and operates LNG infrastructure. The company purchases LNG primarily at fixed, long-term prices and delivers it to customers both on a merchant basis and under long-term contracts. Our investment in the issuer was underpinned by approximately 50% of EBITDA being contracted and the company owning valuable assets that facilitate the transport of low-cost gas from North America to premium-priced gas markets in Puerto Rico, Brazil, Jamaica, and Mexico. Additionally, despite experiencing delays in bringing a large Capex project online, we believed the company would eventually complete the project, leading to improved cash flow.

The combination of poor Q2 earnings, project delays, an overleveraged balance sheet, and concerns about refinancing large near-term maturities caused the company’s bonds and term loan prices to be under pressure in August and September. While the negative move in bond and term loan prices was understandable given the uncertainty, we disagreed with the degree of the price decline and believed the bonds and term loans should trade much higher based on our credit view. In early October, two major catalysts accelerated the price move upward: the company achieved a key milestone related to the large Capex project and completed an LME transaction, which helped extend near-term maturities. This resulted in the NFE 26s increasing by approximately 9 points and the term loan by 4 points in October.

ESG – Virgin Media Bristol

Virgin Media O2 was formed in 2021 as the result of the merger between cable provider Virgin Media and mobile operator O2 UK. The group's ownership is divided 50/50 between Liberty Global and Telefonica. In aggregate, the group's revenues are split between 53% from mobile, 36% from wireline and 11% from others. VMEDO2's operating results were resilient in the last quarter, as EBITDA decline was better than expected driven by strong fixed-line results with ARPU up 2.2% y/y and net adds of 15k. In October, the company’s USD Sustainability Linked Term Loan Y moved up 2 points and was a contributor to performance.

Virgin Media O2 has best-in-class ESG characteristics given its ambitious environmental and social goals, including becoming net zero carbon across its full value chain by 2040, empowering customers to prevent 20 million tons of CO₂ emissions and support large-scale decarbonization by 2025, and connecting 1 million of digitally excluded people across the UK by 2025. As of its 2023 progress report, VMEDO2 has achieved a 23% reduction in scope 1 and 2 emissions since 2022, helped customers prevent 29.9 mt of carbon emissions, and connected 106k of digitally excluded people.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of October 31, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of October 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.